THE WHAT

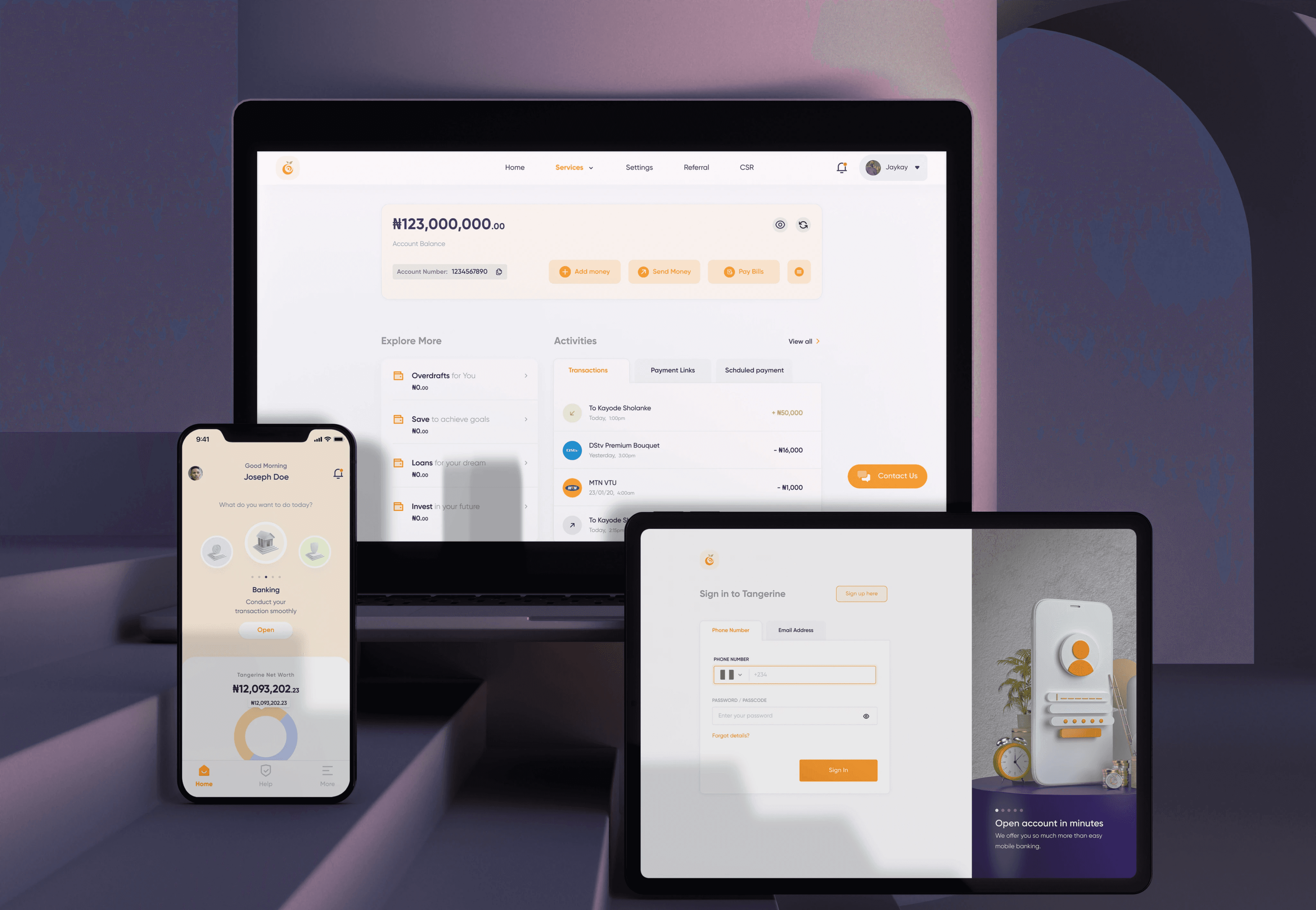

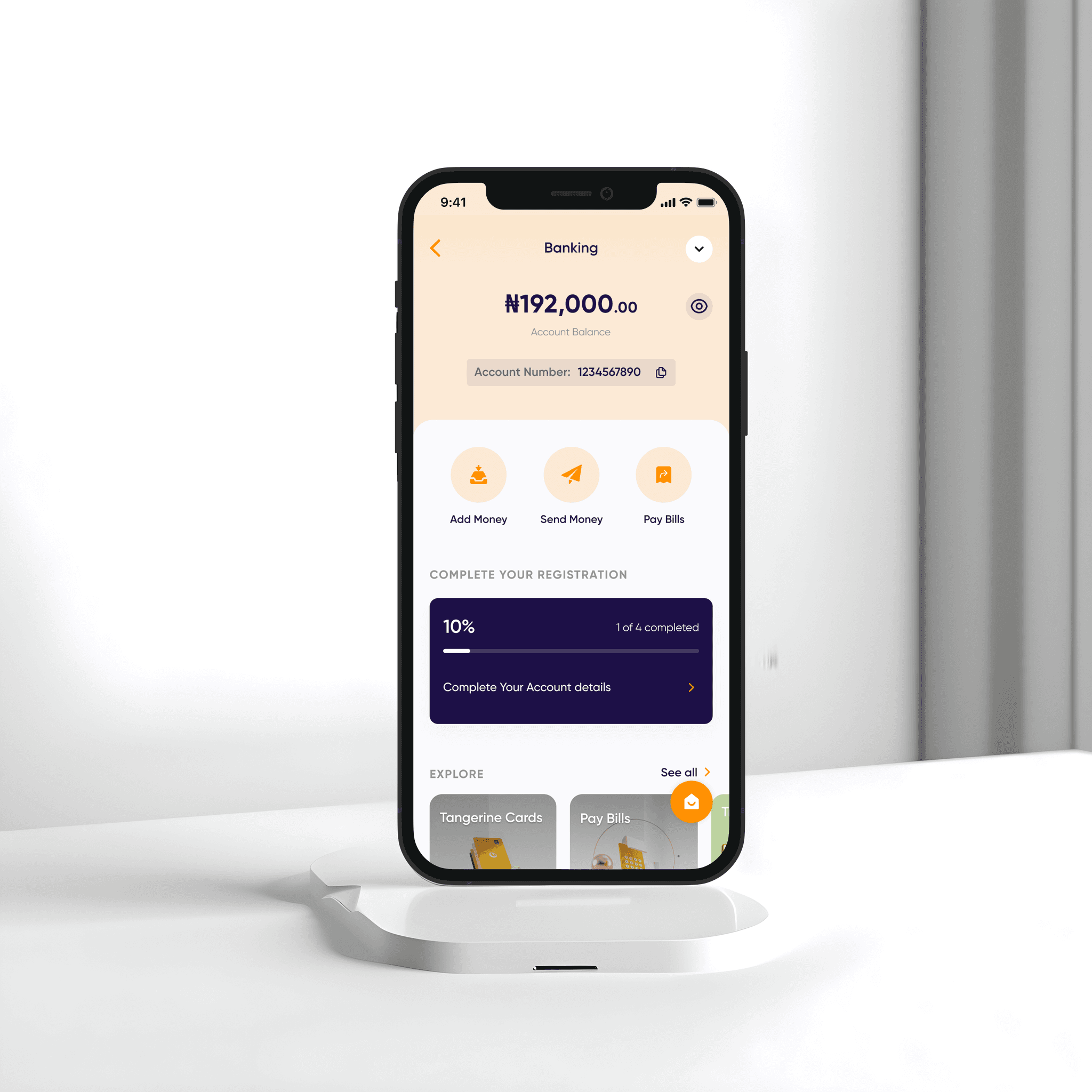

Imagine having a single app that lets you bank, save, spend, insure, invest, and manage your money. This platform can be used for all of the aforementioned purposes in several scenarios. Customers can use it to manage their finances on their own, and business owners can use it to give services to their employees such as insurance and pensions.

THE WHY

Tangerine had been insuring and developing savings plans for customers using the traditional approach for many years. The company sought to digitize the entire process while also introducing additional capabilities so that each customer's financial decisions could be made entirely within the app (both web and mobile).

THE HOW

Component Library

High Fidelity Designs

Usability Testing

TEAM

Product Manager

YEAR

2020-2022

Developers (iOS and Android)

Web Developers

INTERVIEW INSIGHTS

KEY MOTIVATORS

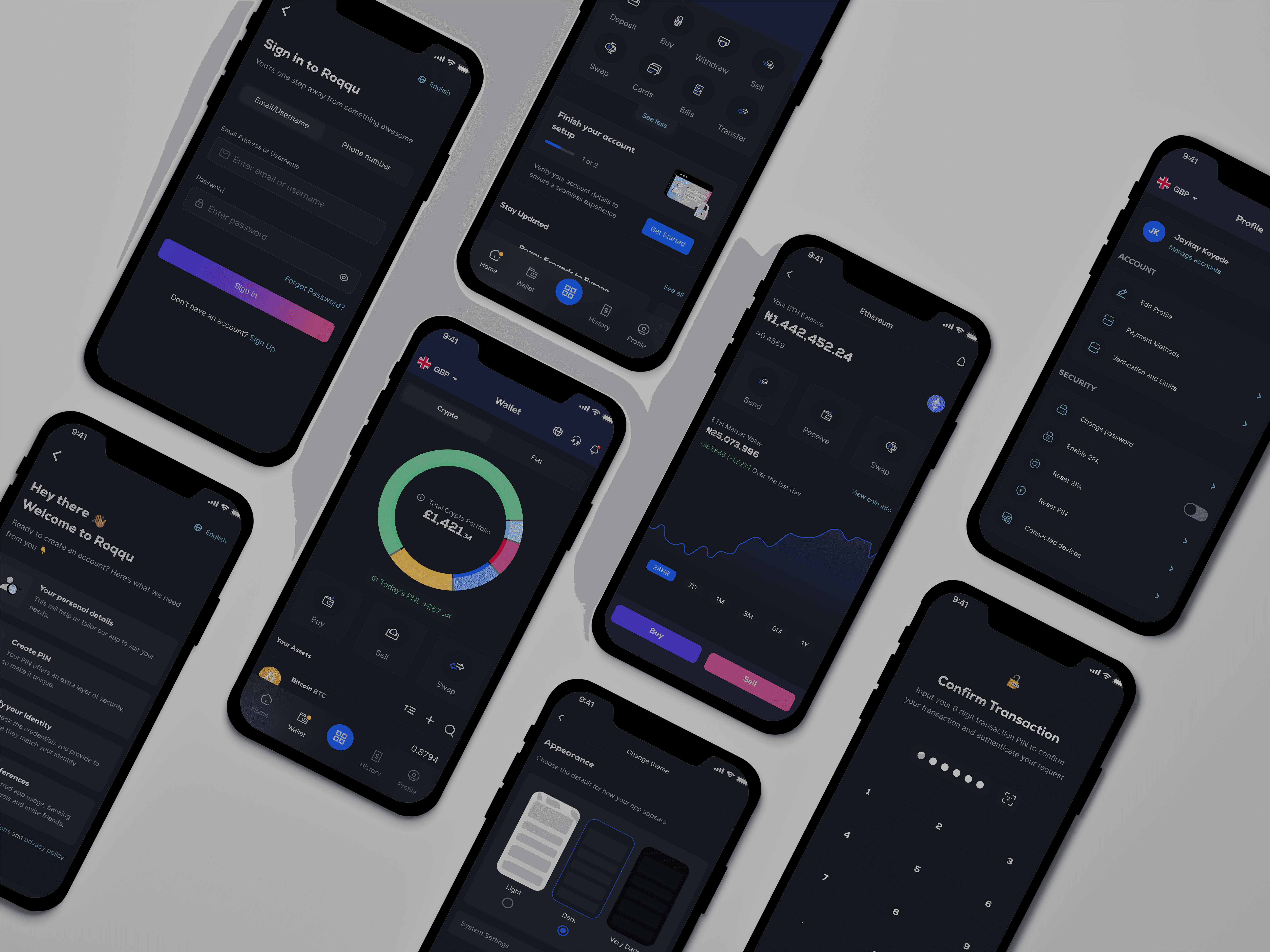

Specific savings alternatives tailored to their savings aim, as well as investment programs to assist them in achieving their savings goals.

Security solutions that are not simple to implement but also effective.

Specific savings alternatives tailored to their savings aim as well as investment programs to assits them in achieving their savings goals.

Financial guidance and education.

To put money into a pension and have access to the profits.

To bank with a company that can anticipate regulatory flaws.

Credit or simple loans with lower interest rates are available.

Investing in higher-yielding assets.

An intuitive platform that suggests financial goods and ideas based on the user’s cash flow, monthly earnings and financial objectives.

No-limit to foreign transactions.

RESEARCH METHODS

THE DESIGN

According to our research, a key priority for users was finding a way to easily sift through options and pinpoint the products they were looking for. In response, from a product perspective, we decided to tackle this challenge by designing a home page that offers a clutter-free browsing experience, showcasing all the products we offer without the distraction of additional features. Building on this, we then crafted an experience tailored to user needs, grounded in our research findings.

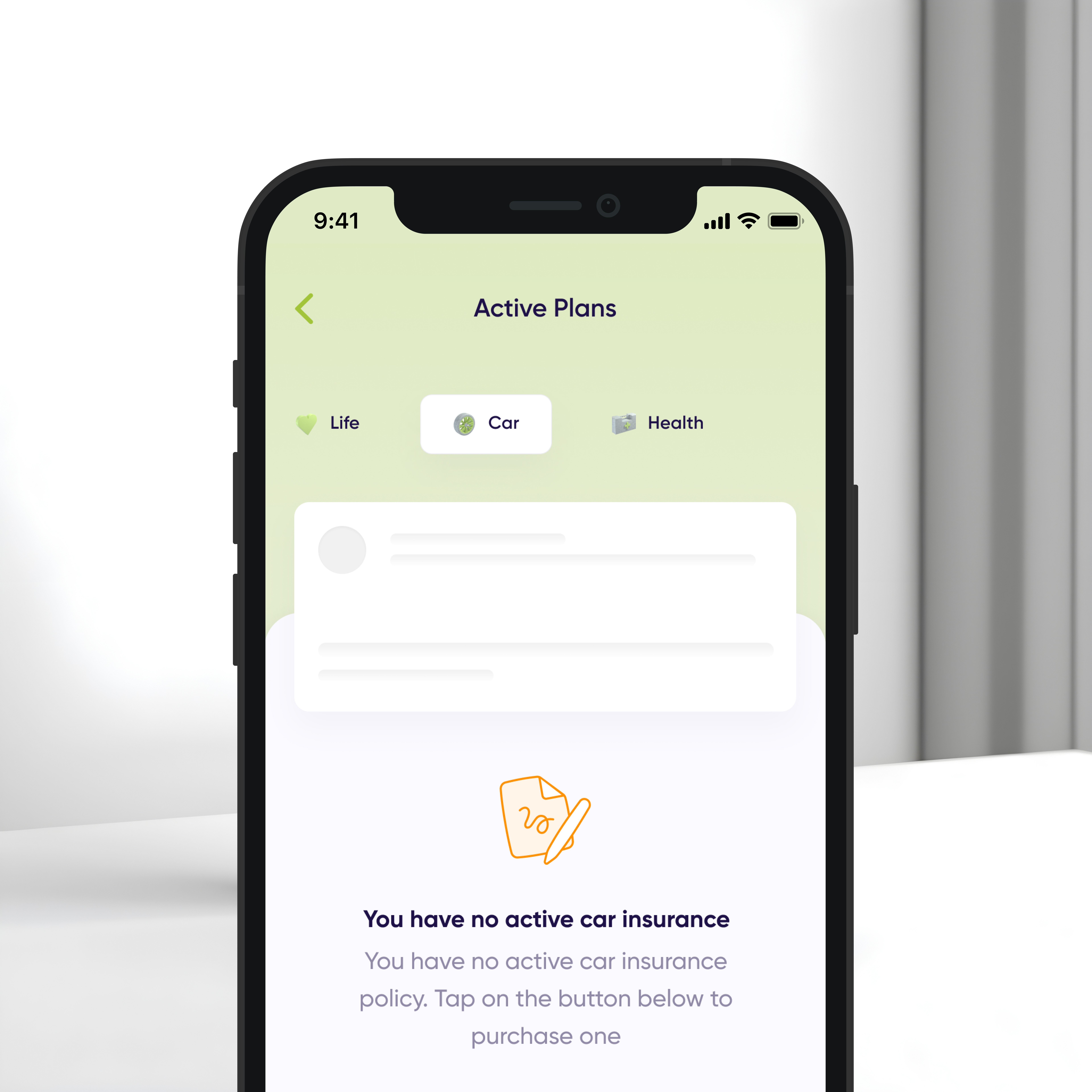

EDUCATING USERS

Given the perception in Nigeria that insurance is primarily for the elderly, our platform aimed to enlighten and encourage both young and old audiences to explore a range of financial solutions. Recognizing potential user challenges, we incorporated tooltips and tutorials to clarify user actions and introduced Tangerine Hub, providing access to an extensive library of articles on insurance and the various products we offer.

This project provided an excellent opportunity to learn about designing for demographics experiencing their first wave of digital disruption in the finance business. It's fascinating because it encourages people to take their financial lives seriously by centralizing their management.

From a product standpoint, we decided to concentrate on resolving this problem by creating a feed that recommends products to clients based on their tastes.

Interact with users and become invested in their lives and financial decisions. To assist people in adding value to their lives rather than detracting from it. This prevents you from making decisions that are self-serving and potentially harmful to users.

Within limitations, design innovates. In nature, too, innovation is cyclical and incremental. To better understand the challenge we're seeking to solve, we focused on tangential solutions that solve real-world problems rather than product solutions.

This method assisted us in defining our KPIs as user goals rather than business goals. The success of the business was inextricably linked to the success of the user because of this asymmetrical approach. We were able to create solutions that will resonate the most with the user by focusing on their success.